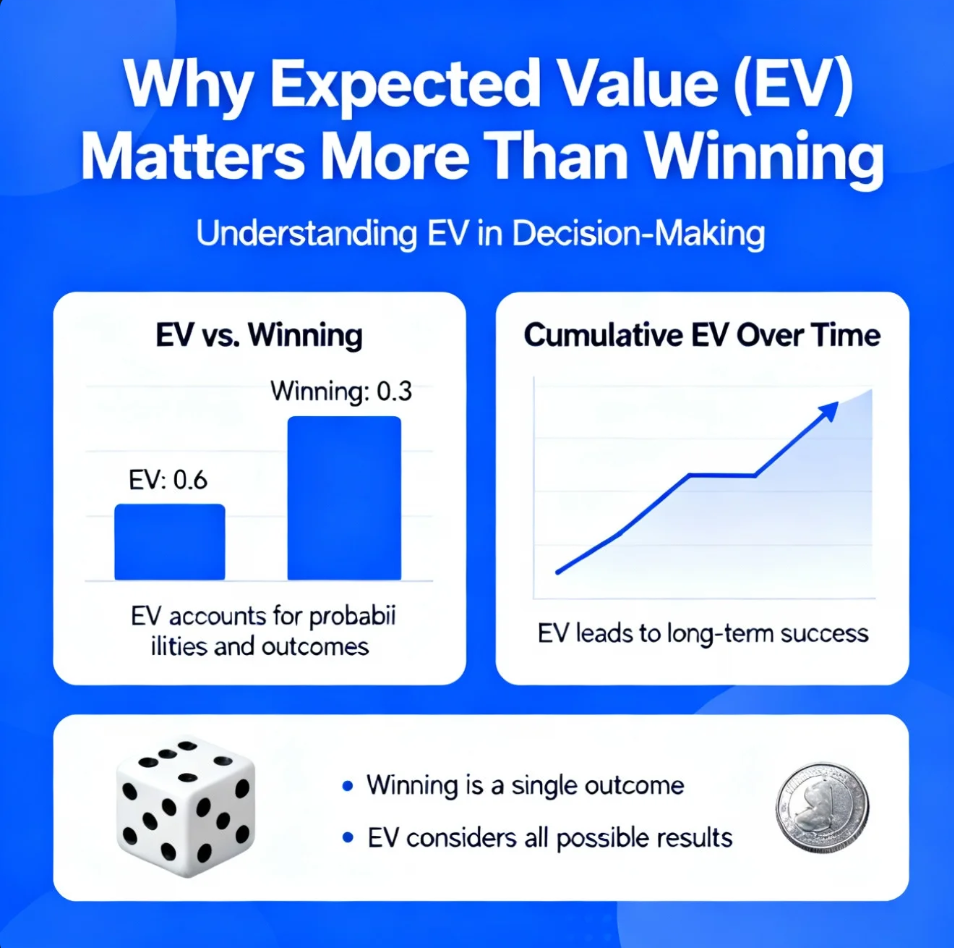

When it comes to gambling, investing, or making risky decisions, many people focus solely on winning. But in reality, focusing on the expected value (EV) of an action is far more important. Expected value is a mathematical concept that measures the average outcome of repeated trials, helping you make rational, long-term decisions instead of chasing short-term luck.

Understanding EV is a game-changer for anyone seeking consistent success in both games and life.

What Is Expected Value (EV)?

Expected value is the weighted average of all possible outcomes of a decision, accounting for both probability and payoff.

Formula for EV:EV=∑(Probability×Outcome)

For example, if you have a 50% chance to win $100 and a 50% chance to lose $50:EV=(0.5×100)+(0.5×−50)=50−25=25

Even if you don’t win every time, the decision has a positive EV of $25, meaning it’s beneficial in the long run.

Why EV Matters More Than Winning

1️⃣ Focus on Long-Term Success

Winning once may feel satisfying, but EV measures consistent, repeatable advantage. Players or investors who prioritize EV build wealth or success over time.

2️⃣ Removes Emotional Bias

Many decisions are influenced by hope, fear, or superstition. Calculating EV encourages rational, numbers-based thinking, reducing impulsive mistakes.

3️⃣ Helps Compare Choices

EV allows you to compare different strategies or bets objectively, even if outcomes seem similar at first glance.

4️⃣ Highlights Risk vs Reward

A negative EV action may offer a chance to win big but loses value over time. EV helps you balance risk and reward wisely.

Examples of EV in Real Life

- Casino games: Blackjack and poker rely heavily on EV for strategic decisions.

- Investing: Choosing between stocks, bonds, or projects based on long-term average returns.

- Sports betting: Calculating odds and payouts to identify profitable bets over many games.

- Business decisions: Evaluating potential profits vs. likelihood of success for new ventures.

In each case, focusing solely on wins can be misleading, while EV guides smarter, sustainable strategies.

Common Misconceptions

- “I lost, so my decision was wrong.”

Short-term losses can happen even with positive EV decisions. Focus on the long-term trend, not isolated outcomes. - “EV guarantees a win.”

EV predicts averages over many repetitions, not individual results. It reduces risk but does not eliminate variance.

Conclusion

While winning feels great in the moment, expected value (EV) is the true measure of a smart decision. By focusing on EV instead of single outcomes, you make choices that maximize success, minimize risk, and build consistent results—whether in gambling, investing, or everyday life.

In short: EV is the path to long-term wins, even if you lose occasionally along the way.